Why ‘Payment-In-Kind’ Debt Is So Appealing — and Risky

When private equity firms buy up target companies, they rely on one major source of financial firepower — debt, and lots of it. But what happens when the interest on that debt jumps? For some, the answer is simple: pay it later.

当私募股权公司收购目标公司时,它们依赖一个主要的资金来源——债务,而且是大量的债务。但是当这些债务的利息飙升时会发生什么?对有些人来说,答案很简单:以后再付。

In today’s “higher-for-longer” rate environment, so-called payment-in-kind debt, otherwise known as PIK, is an appealing but risky way for buyout firms to keep their spending to a minimum while they try to extract returns from the businesses they’ve acquired.

在当今“更高利率更持久”的环境下,所谓的以实物或实物等价物支付的债务(即 PIK)对收购公司来说是一种具有吸引力但风险较高的方式,使它们在努力从所收购的企业中获取回报时能够将支出降至最低。

It allows them to push back interest payments until the moment when the debt itself has to be repaid. PIK was first popularized by bankers in the 1980s, and made a name for itself when it was used for one of the world’s most famous leveraged buyouts — KKR & Co.’s takeover of RJR Nabisco in 1988.

它允许借款人在必须偿还债务之前推迟利息支付。PIK 最早在 1980 年代由银行家推广,并在被用于世界上最著名的杠杆收购之一时声名鹊起——KKR & Co.于 1988 年收购 RJR Nabisco。

PIK debt is still relatively rare. For one thing, collateralized loan obligations — the financial products used most often by investors to bundle their leveraged loans — are typically limited in how much PIK debt they can hold.

PIK 债务仍然相对罕见。一方面,用于投资者打包杠杆贷款的金融产品——担保贷款义务(CLO)——通常对其所能持有的 PIK 债务数量有严格限制。

But with central banks delaying a shift to lower borrowing costs, PIK is becoming more popular by the day.

但随着各国央行推迟转向更低借贷成本,PIK 正日益流行。

What is payment-in-kind debt?

The interest gets added onto the initial amount of money borrowed when it comes due and is compounded, meaning the underlying debt grows over its lifetime. While PIK can alleviate a short-term cash crunch, it can end up being far more expensive than normal debt.

到期时,利息会被加到最初借款本金上并复利计算,这意味着基础债务在其存续期内会增长。虽然 PIK 可以缓解短期现金紧张,但最终可能比普通债务昂贵得多。

There are several flavors of PIK. “Pay-if-you-can” bonds switch from regular interest payments to payment-in-kind when certain conditions laid out in the bond terms are met. There are also “pay-if-you-like” toggle bonds that offer a choice between paying regular interest or switching to PIK.

PIK 有几种不同形式。“能付就付”(pay-if-you-can)债券在债券条款规定的某些条件触发时,从常规利息支付切换为以债务形式支付利息(payment-in-kind)。还有“随你选”(pay-if-you-like)可切换债券,允许在支付常规利息或改为 PIK 之间选择。

At some point, however, the borrower needs to pay up or else negotiate with lenders to push back maturity dates, reset the terms, or refinance — reimburse the debt using money from new investors.

不过,在某个时点,借款方还是需要偿付,否则就得与贷款方协商延后到期日、重设条款或再融资——用新投资者的钱偿还旧债。

PIK can only do so much for a company that’s already struggling. In April 2023, WeWork swapped around $1 billion of its bonds for new PIK notes with double-digit percentage yields, and issued new PIK bonds at an eye-watering return of 15%. The move didn’t stop the company later sliding into Chapter 11 bankruptcy.

对于已经陷入困境的公司,PIK 的作用是有限的。2023 年 4 月,WeWork 将约 10 亿美元的债券置换为新的 PIK 票据,收益率达到两位数百分比,并发行了收益率高达 15%的新 PIK 债券。这一举措仍未阻止该公司随后陷入第 11 章破产保护。

How does PIK work?

PIK is one of the riskiest types of debt, for several reasons.

PIK 是风险最高的债务类型之一,原因有数。

It doesn’t come cheap, with some borrowers racking up a PIK interest burden of 21% on an annualized basis. The gamble is that management will use the money saved in the short term to make the acquired business profitable enough to pay off a bigger chunk of debt down the road.

它并不便宜,有些借款人的 PIK 利息负担年化高达 21%。这种赌博的前提是管理层会利用短期节省下来的资金,使被收购业务在未来变得足够盈利,从而能够偿还更大部分的债务。

If the business goes bad, investors not only miss out on cash payments but saddle themselves with a riskier borrower that buckles under the strain of its mounting debts. This threatens the repayment of even the principal.

如果业务恶化,投资者不仅失去现金支付,还背负上一个在不断增加的债务压力下会崩溃的更高风险的借款方。这甚至威胁到本金的偿还。

PIK debt is typically subordinated and unsecured, which means its providers only get paid after all other lenders have been reimbursed, and they have no claim on any company assets.

PIK 债务通常为次级且无担保,这意味着其提供者仅在所有其他贷方获得偿付后才会得到支付,并且他们对任何公司资产没有索偿权。

It’s also often raised at the parent- or holding-company level of a business, as opposed to the operating company — the part of the organization that brings in revenue. In this way, a business can increase the amount of debt it has and avoid triggering rules that would otherwise limit leverage.

这类债务也经常在企业的母公司或控股公司层面提出,而不是在带来收入的经营公司层面。通过这种方式,企业可以增加其债务规模,并避免触发那些本可能限制杠杆率的规则。

Why do companies want to raise payment-in-kind debt now?

PIK is appealing for companies in today’s higher-for-longer interest-rate environment as some are being forced to pay three times more to service their debt when it comes up for refinancing.

在当下利率“更高且更持久”的环境中,PIK 对一些在再融资时被迫支付三倍以上利息以偿债的公司具有吸引力。

Private equity firms have been turning to PIK in order to make their buyouts less expensive upfront. This can give the target company some breathing room so it can focus on growth and invest more money in its operations.

私募股权公司正转向使用 PIK,以降低其收购交易的前期成本。这可以为目标公司争取喘息空间,使其能够专注于增长并在运营上投入更多资金。

When markets are at their frothiest, shareholders have been known to pile PIK onto a company to pay themselves a dividend. Such deals were popular in the run-up to the 2008 financial crisis, as well as during the subsequent easy-money era. Packaging company Ardagh Group, owned by Irish billionaire Paul Coulson, is a notable example.

当市场最为泡沫化时,股东们曾被发现用 PIK 向公司注入资金以向自己支付股息。在 2008 年金融危机前夕以及随后的宽松货币时代,这类交易曾很流行。包装公司 Ardagh Group(由爱尔兰亿万富翁 Paul Coulson 持有)就是一个著名例子。

Who is providing PIK?

Private credit funds are the main driver of the trend. During the decade of rock-bottom interest rates following the global financial crisis, PIK fell out of fashion because debt was so freely available elsewhere — and at a much lower cost. Today, with companies looking for creative ways to deal with higher rates, private credit providers have been offering the option once more. It gives direct lenders an edge over Wall Street banks because PIK is harder to sell in traditional syndicated markets.

私募信贷基金是这一趋势的主要推动力。在全球金融危机后那十年超低利率期间,PIK 式融资曾一度失宠,因为债务在其他渠道如此充裕——且成本远低于 PIK。如今,随着公司寻求应对更高利率的创意方式,私募信贷提供者又重新开始提供这一选项。由于 PIK 难以在传统的银团市场出售,这给直接出借方相较华尔街银行带来了优势。

PIK is increasingly popular. Among the ten largest US Business Development Companies — entities that raise capital to lend to small and medium-sized businesses — 17% of loan portfolios contained at least some PIK notes, according to a Bloomberg Intelligence report in February. That’s up from 10.5% the previous year.

PIK 日益流行。根据彭博情报二月的一份报告,在美国十大最大商业发展公司(Business Development Companies——筹集资金以向中小企业放贷的实体)中,17%的贷款组合至少包含部分 PIK 票据。此前一年这一比例为 10.5%。

One recent example is a $1.1 billion PIK note provided by Carlyle Group and Goldman Sachs Private Credit to fund administrator Apex Group.

最近的一个例子是由凯雷集团和高盛私人信贷提供的 11 亿美元的 PIK 票据,用于为基金管理公司 Apex Group 提供资金。

Read More: Why Is Private Credit Booming? How Long Can It Last?: QuickTake

阅读更多:为什么私人信贷如此繁荣?它能持续多久?:快讯

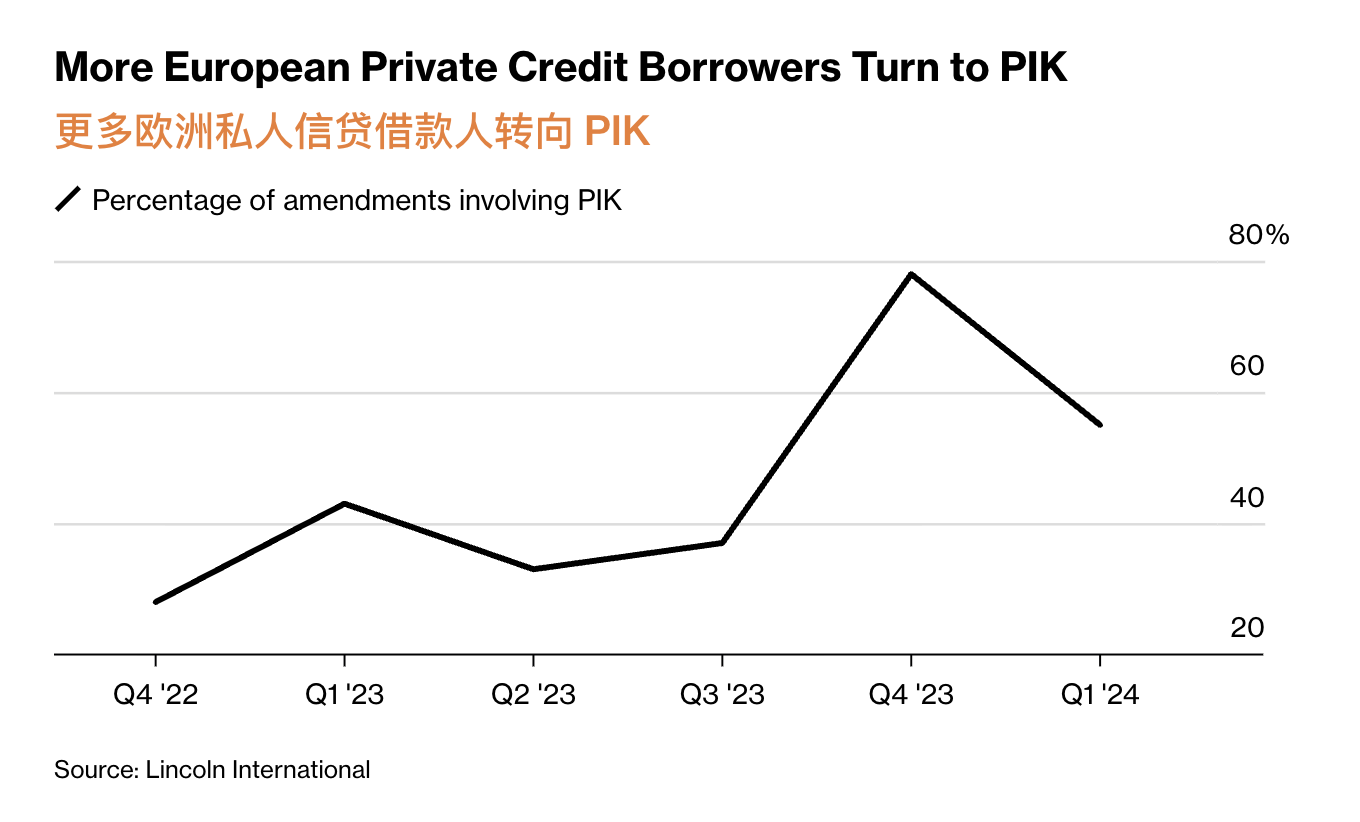

Private credit providers have also allowed struggling borrowers to tweak the terms of their existing debt and shift to PIK-style interest payment arrangements. In Europe, more than half of all amendments made to private credit-provided debt in the first quarter of 2024 involved a PIK component, according to data from Lincoln International.

为私人信贷提供者也允许陷入困境的借款人调整其现有债务条款并转为以 PIK 形式支付利息。据 Lincoln International 的数据,2024 年第一季度在欧洲对私人信贷提供的债务所做的所有修订中,有一半以上涉及 PIK 成分。

Even banks are willing to offer PIK, with some pitching broadly syndicated refinancings using the debt instruments in order to poach business back from private lenders. These PIK bonds are still rare, with only a handful sold in Europe’s high-yield bond market since Russia’s full-scale invasion of Ukraine in 2022.

即便是银行也愿意提供 PIK,有些银行以此类债务工具为卖点,推动广泛承销的再融资,以此从私人贷款人手中夺回业务。这类 PIK 债券仍然罕见,自 2022 年俄罗斯全面入侵乌克兰以来,欧洲高收益债券市场仅有少数几只发行。

What are risks?

PIK is risky for almost everyone involved. For shareholders, the most worrying aspect of PIK debt is the way it can snowball to a size that eats into the equity of the business. Lenders of senior debt are probably safest in that they should always be paid back before the lenders of PIK debt and so face the lowest risk of losing money in a bankruptcy.

对几乎所有相关方而言,PIK 都具有风险。对股东而言,PIK 债务最令人担忧的方面是其可能像滚雪球一样增长到侵蚀公司股权的规模。高级债权人的安全性可能最高,因为在破产情况下他们应当始终在 PIK 债权人之前获得偿付,因此面临的损失风险最低。

But that assumes their lender protections are strong enough to stop the owners and management of the business siphoning off cash or assets out of the structures that the senior lenders have claims to in order to pay off the PIK debt instead. A lot of weak lending documentation signed in 2021 and 2022 allows borrowers more leeway to do this.

但那建立在他们的贷款人保护足够强大的假设上,以阻止企业的所有者和管理层从高级贷款人有追索权的结构中抽走现金或资产来偿还 PIK 债务。许多在 2021 和 2022 年签署的条款薄弱的借贷文件允许借款方有更大的余地这样做。

Yes, plenty of times — most notably:

是的,很多次——尤其值得注意的有:

- EB Holdings II, the holding company for Howard Meyers’ worldwide metals empire, filed for bankruptcy protection in 2019 after a years-long fight with hedge funds over a €600 million (2.5 billion liability.

EB Holdings II,即 Howard Meyers 全球金属帝国的控股公司,于 2019 年在与对一笔 2007 年签署的 6 亿欧元(6.51 亿美元)PIK 贷款协议的对冲基金多年争斗后申请了破产保护,该协议据称随时间增长至 25 亿美元的负债。 - The US Glazer family piled debt onto Manchester United when they bought the English soccer club in 2005. That included more than £200 million ($258 million) worth of PIK notes that ballooned in cost, fueling angry protests by club supporters. If the PIK debt hadn’t eventually been paid down and was held to maturity, it would have ballooned to almost £600 million.

当美国的格雷泽家族于 2005 年买下英格兰足球俱乐部曼联时,他们在俱乐部身上叠加了债务。其中包括超过 2 亿英镑(2.58 亿美元)的 PIK 票据,这些票据成本膨胀,引发了俱乐部支持者的愤怒抗议。如果这些 PIK 债务最终没有被偿还而是持有到期,其规模将膨胀到近 6 亿英镑。

Read More: Private Equity’s Creative Wizardry Is Obscuring Danger Signs

阅读更多:私募股权的创意魔法正在掩盖危险信号

Get Alerts for: