Wall Street Blows Past Bubble Worries to Supercharge AI Spending Frenzy

Blue Owl 协助为位于德克萨斯州阿比林的 Stargate AI 数据中心提供融资,该中心是 OpenAI 与 Oracle 的合作项目。KYLE GRILLOT/BLOOMBERG NEWS

Wall Street Blows Past Bubble Worries to Supercharge AI Spending Frenzy华尔街无视泡沫担忧,推动人工智能支出狂潮

Summary: Firms such as Blue Owl Capital have raised trillions in investing firepower. The artificial-intelligence build-out is a perfect match, though warning signs are flashing.像 Blue Owl Capital 这样的公司已经筹集了数万亿美元的投资火力。人工智能的扩建与之完美契合,尽管警示信号正在闪烁。

Not long ago, Blue Owl Capital OWL -5.81% decrease; red down pointing triangle was an upstart investment firm that lent money to midsize U.S. companies such as Sara Lee Frozen Bakery.

不久之前,Blue Owl Capital OWL-5.81% 还是一家新兴的投资公司,向 Sara Lee Frozen Bakery 等美国中型企业提供贷款。

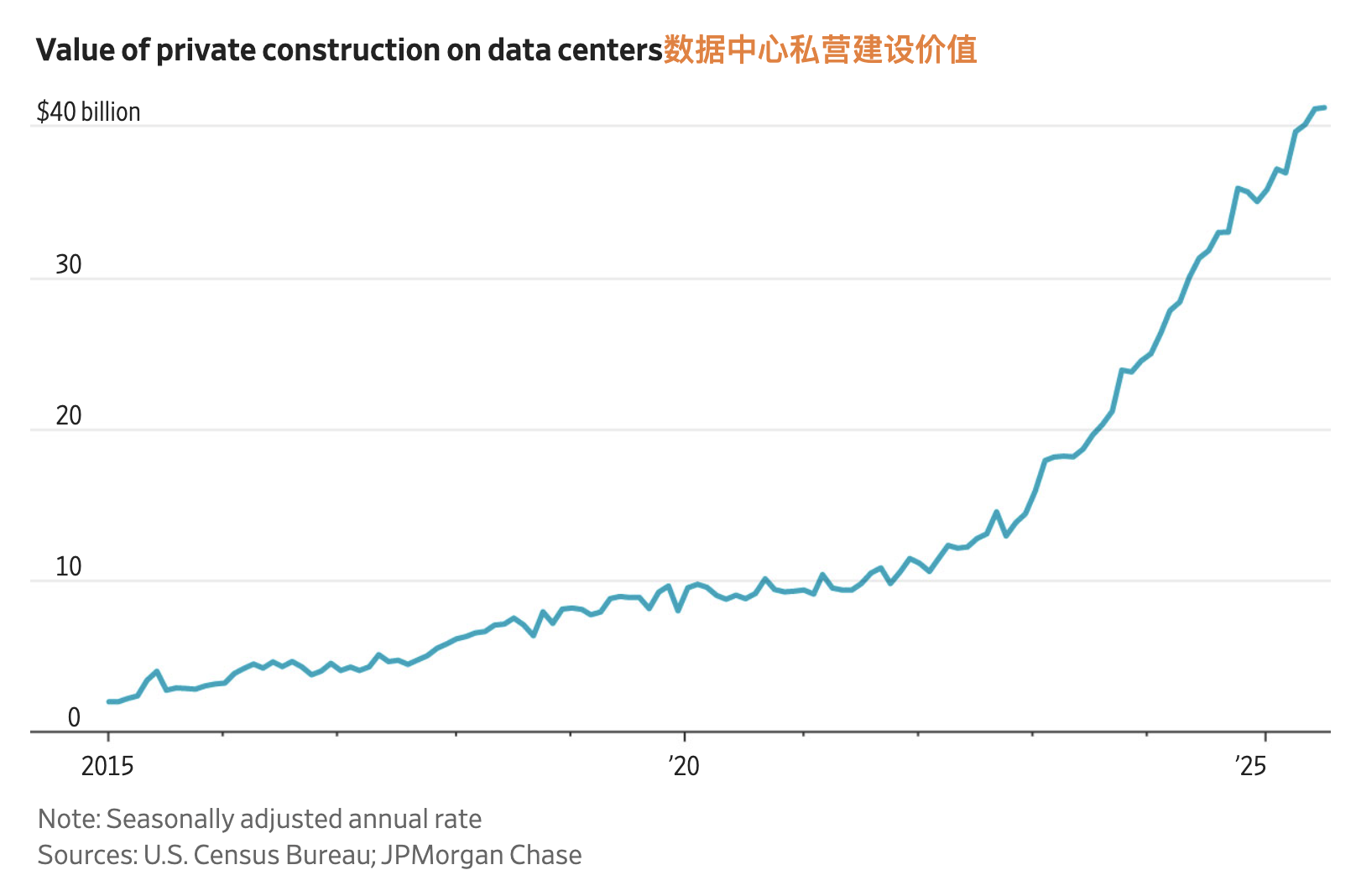

These days, the firm is financing massive data centers costing tens of billions of dollars for the likes of Meta and Oracle —a sign of just how quickly Wall Street has become the enabler of America’s artificial-intelligence boom.

如今,这家公司为 Meta 和 Oracle 等公司融资建设耗资数百亿美元的大型数据中心——这表明华尔街多么迅速地成为了美国人工智能繁荣的推动者。

Fund managers such as Blue Owl amassed trillions of dollars of investing firepower and have been hunting for big deals where they can put that money to work. They found slim pickings for years until a perfect match appeared in AI, which has provided a bigger target than anything in history due to the vast sums tech companies need to ramp up computing power.

像 Blue Owl 这样的基金经理积累了数万亿美元的投资火力,并一直在寻找可以投入这些资金的大宗交易。多年来他们发现可选目标很少,直到人工智能出现了完美契合:由于科技公司需要大规模提升计算能力,人工智能带来了史上最大的投资目标。

“We’re talking about numbers that are so large, even in the low cases,” said Blue Owl co-founder Marc Lipschultz. “Does it even matter if you keep counting after you get to $1 trillion of capital expenditure in the next couple of years?”

“我们在谈论的数字是如此庞大,即便是较低的估算也很可观,”Blue Owl 联合创始人 Marc Lipschultz 说。“在未来几年里,如果资本支出达到 1 万亿美元之后,你还继续计数,那还有意义吗?”

Last week’s selloff in tech-related stocks and bonds marked some of the most serious warning signs that the frenzy could be overdone. But any worries on Wall Street about a possible investment bubble have largely been trumped by the fear of being left behind.

上周与科技相关的股票和债券的抛售标志着一些最严重的警告信号,表明这一热潮可能过火。但华尔街对潜在投资泡沫的任何担忧在很大程度上被对“落后”的恐惧所压倒。

Lipschultz and co-founder Doug Ostrover jumped into the fray at a posh retreat in California’s Ojai Valley for dozens of tech VIPs and celebrities in the spring of 2024. Meta CEO and Microsoft CEO were there, along with Pharrell Williams and Serena Williams.

Lipschultz 与联合创始人 Doug Ostrover 在 2024 年春季于加利福尼亚 Ojai 山谷的一次豪华隐退会上加入了这场争论,该活动为数十位科技 VIP 和名人而设。Meta 首席执行官 Mark Zuckerberg 和 Microsoft 首席执行官 Satya Nadella 出席了活动,旁有 Pharrell Williams 与 Serena Williams。

The Blue Owl duo, Wall Street superstars who built the firm into a $295 billion fund manager in 10 years by perfectly timing a surge in private lending, looked like just two money men in office sneakers and fleece vests. But the billionaires—co-owners of a professional hockey team who have talked of “skating where the puck is going”—seized the opportunity to get in on the AI boom.

布鲁乌(Blue Owl)二人组是华尔街的超级明星,他们在过去 10 年通过把握私募贷款激增的时机,把公司打造成为管理 2950 亿美元资产的基金管理人。他们看起来就像穿着办公运动鞋和抓绒背心的两个金融人士。但这两位亿万富翁——拥有职业冰球队共同所有权、曾谈及“滑向冰球将要去的方向(skating where the puck is going)”——抓住了参与人工智能热潮的机会。

While David Guetta DJ’d, the Blue Owl executives cut a deal to acquire IPI Partners, an investment firm that owned and operated big data-centers for Amazon and Microsoft.

在大卫·盖塔(David Guetta)担任 DJ 的同时,布鲁乌高管完成了一笔收购交易,收购了 IPI Partners,一家为亚马逊和微软拥有并运营大规模数据中心的投资公司。

Blue Owl already had close ties with the organizer of the retreat, Iconiq Capital, which manages the personal fortunes of Silicon Valley elite—including Zuckerberg—and was a part-owner of IPI.

布鲁乌与该闭门会议的组织者 Iconiq Capital 已有密切关系,Iconiq 管理着硅谷精英(包括 Zuckerberg)的个人财富,并且是 IPI 的部分所有者。

The purchase gave Blue Owl a seat at the table to bid on mega AI financings. Not long after, it got picked to arrange a $14 billion package for an Oracle and OpenAI data center in Abilene, Texas.

这笔收购让布鲁乌获得了参与竞购大型人工智能融资的席位。不久之后,他们被选中安排为位于德克萨斯州阿比林的 Oracle 与 OpenAI 数据中心提供 140 亿美元的融资方案。

Then, last month, Blue Owl raised about 3 billion of its clients’ money and borrowing the rest. The deal included a provision, considered extraordinary on Wall Street, giving Blue Owl’s equity investment a debtlike guarantee in case the partnership falls apart—showing the new financial wizardry bankers are conjuring to meet AI’s ravenous financial demand.

然后,上个月,Blue Owl 募集了约 300 亿美元,用于在路易斯安那为 Meta 建设一个 AI 数据中心,其中投入了 30 亿美元的客户资金并借入其余款项。该交易包含一项在华尔街被视为非常规的条款,为 Blue Owl 的股权投资提供类似债务的担保,以防合作关系破裂——这显示出银行家为满足 AI 那贪得无厌的资金需求而施展出的新型金融手段。

Marc Lipschultz and Doug Ostrover.Kevin Hagen for WSJ

Spreading the risk

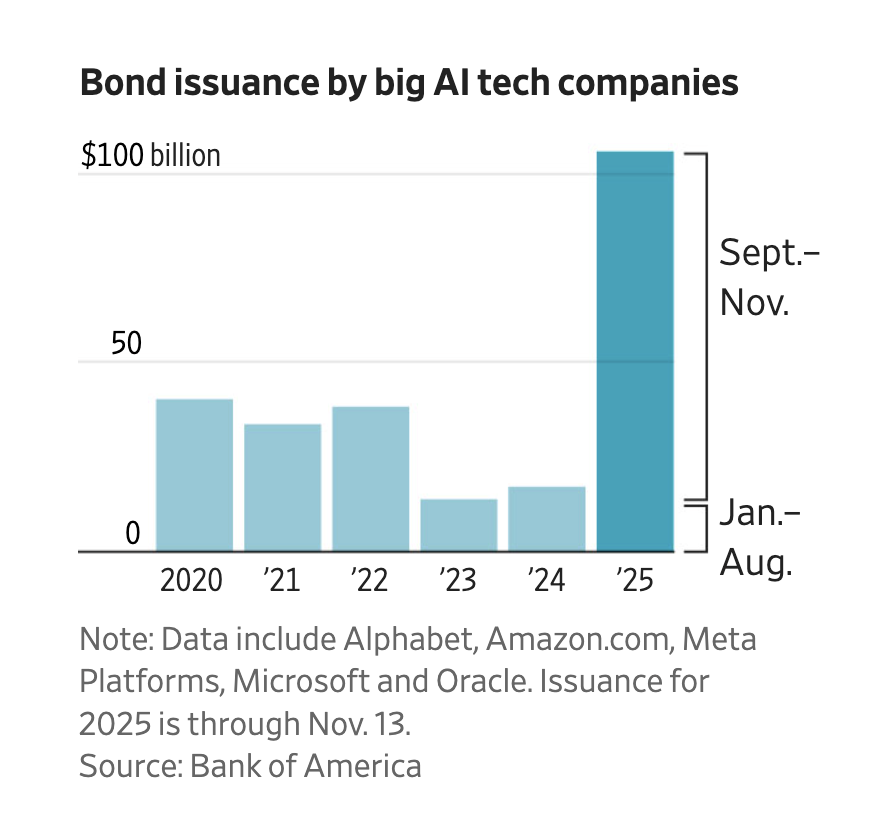

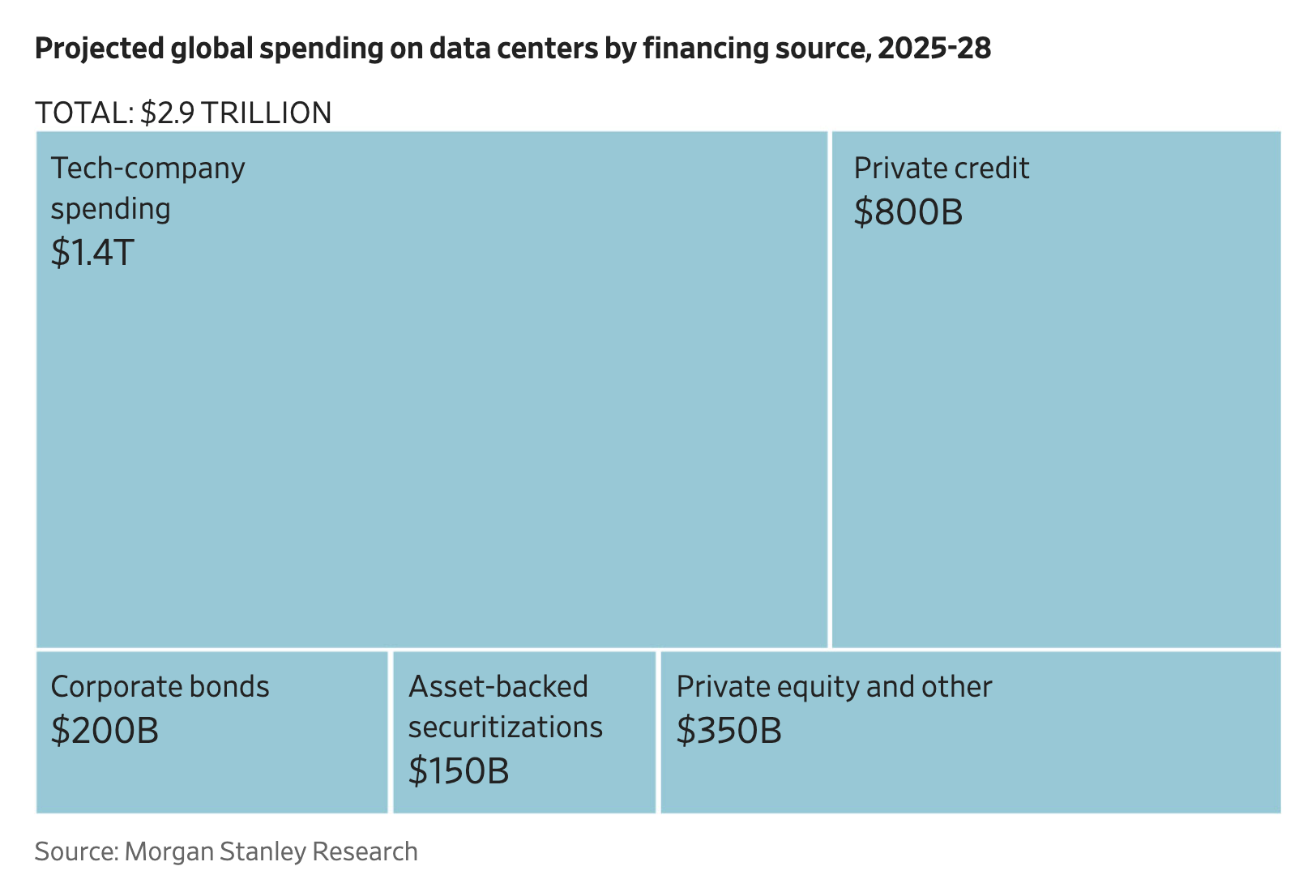

Silicon Valley’s biggest players are flush with cash and were able to fund much of the initial AI build-out from their own coffers. As the dollar figures climb ever higher, they are turning to debt and private equity—spreading the risks and potential rewards more broadly across the economy.

硅谷最大的参与者现金充足,能够用自有资金为最初的人工智能建设提供大部分资金。随着资金规模不断攀升,他们开始转向债务和私募股权——将风险和潜在回报更广泛地分散到整个经济中。

Some of the financing is coming from plain-vanilla corporate bond sales, but financiers are making far bigger fees off giant private deals. Virtually every Wall Street player is angling to get a piece of the action, from banks such as JPMorgan Chase and Morgan Stanley to traditional asset managers such as BlackRock.

部分融资来自普通公司债券发行,但金融家们从巨额私募交易中收取的费用要大得多。几乎每一家华尔街参与者都在争取分一杯羹,从 JPMorgan Chase 和 Morgan Stanley 等银行到 BlackRock 等传统资产管理公司。

Investor appetite for data-center debt is so strong that some money managers have booked billion-dollar gains in a matter of days, even before construction of the facilities they are financing is complete. 投资者对数据中心债务的需求如此强劲,以至于一些基金经理在短短几天内就已录得数十亿美元的收益,甚至在他们所融资的设施建设尚未完工之前便已实现。

Still, the longer-term performance is hardly assured. Big tech companies are expected to spend nearly $3 trillion on AI through 2028 but only generate enough cash to cover half that tab, according to analysts at Morgan Stanley.

尽管如此,长期表现并不确定。摩根士丹利的分析师预计,大型科技公司到 2028 年在人工智能方面的支出将接近 3 万亿美元,但其产生的现金仅足以支付这一费用的一半。

Big names in the financial world, such as Goldman Sachs CEO , are warning about AI-fueled froth in the markets and in capital spending.

金融界的大牌人士,例如高盛首席执行官 David Solomon,正在警告市场和资本支出中由人工智能驱动的泡沫。

At the same time, the fear of missing out is real. Days after Solomon voiced his concerns to analysts, Goldman formed a new team in its banking and markets group focused on AI infrastructure financing.

与此同时,对错失良机的担忧确实存在。在 Solomon 向分析师表达担忧几天后,高盛在其银行与市场集团内组建了一个专注于 AI 基础设施融资的新团队。

“What we do know for certain is that the [big tech companies] that want the world to spend trillions have huge financial incentives to be believers. In case you haven’t noticed, Wall Street is also being paid a lot to promote the story,” Greenlight Capital, the hedge-fund firm run by David Einhorn, wrote in an October letter to investors.

“我们唯一可以肯定知道的是,那些希望全世界花费数万亿的(大型科技公司)有巨大的财务动机去成为信徒。如果你还没注意到,华尔街也同样被大量付费来推广这个故事,”由大卫·艾因霍恩运营的对冲基金公司 Greenlight Capital 在十月给投资者的信中写道。

There have been some wobbles of late. Stock prices normally go up when a company reports record revenue but after Meta did just that on Oct. 29, its shares plummeted 11% instead. The reason: Zuckerberg disclosed he will “aggressively” increase capital spending on AI, drawing questions from analysts about how the company plans to actually make money off the new technology**.**

最近出现了一些动荡。通常公司在报告创纪录收入时股价会上涨,但在 Meta 于 10 月 29 日刚好这么做之后,其股价反而暴跌了 11%。原因是:扎克伯格披露他将“积极”增加对 AI 的资本支出,这引发分析师对公司究竟如何从这项新技术中真正获利的质疑。

Workstations at the Blue Owl office inside the Seagram Building in New York.

Blue Owl has grown into a $295 billion fund manager thanks to the surge in private lending.Jose A. Alvarado Jr/Bloomberg News

由于私募借贷激增,Blue Owl 已发展成为资产管理规模达 2950 亿美元的基金管理公司。JOSE A. ALVARADO JR/BLOOMBERG NEWS

If the AI market blows up, the blast radius would be wide, hitting not only Wall Street firms, but also pensions, mutual and exchange-traded funds and individual investors, because of how debt is often sliced and resold across the financial landscape.

如果人工智能市场爆发,冲击范围将很广,不仅会影响华尔街公司,还会波及养老基金、共同基金和交易所交易基金以及个人投资者,因为债务常常被切分并在金融领域广泛转售。

The bonds financing Meta’s Hyperion data center in Louisiana can be found in Main Street funds offered by BlackRock, Invesco, Janus Henderson and Pimco. Investors in Blue Owl’s latest $7 billion digital infrastructure fund include the state pension plans of Pennsylvania and New York.

为 Meta 在路易斯安那州的 Hyperion 数据中心提供融资的债券可以在 BlackRock、Invesco、Janus Henderson 和 Pimco 提供的 Main Street 基金中找到。Blue Owl 最新 70 亿美元数字基础设施基金的投资者包括宾夕法尼亚州和纽约州的州级养老金计划。

Funds that invest in AI deals say they carry little risk, because tech companies with deep pockets have ironclad leases that will generate the money to pay investors back. Microsoft has a higher credit rating than the U.S. government, and it told investors on Oct. 29 that it would double its total data-center footprint in the next two years.

投资于人工智能项目的基金称它们承受的风险很小,因为资金雄厚的科技公司拥有铁一般的租约,这些租约将产生偿还投资者的资金。Microsoft 的信用评级高于美国政府,并且它在 10 月 29 日告诉投资者,未来两年内将把其数据中心总规模扩大一倍。

Tech executives see more risk in underbuilding than overbuilding. “I thought we were going to catch up. We are not. Demand is increasing,” Microsoft finance chief Amy Hood said.

科技高管认为,建设不足比建设过度的风险更大。“我以为我们会迎头赶上。事实并非如此。需求在增长,”Microsoft 财务负责人 Amy Hood 说道。

But some tech companies are weaker financially than others. Oracle, which is angling to be the go-to computing provider for labs like OpenAI, is by far the most indebted tech giant in the mix. It needs to borrow billions more for its spending spree, prompting Moody’s Ratings and S&P Global Ratings to edge closer to reclassifying Oracle’s bonds as junk debt. In recent weeks, the company’s stock price has fallen 32% and its bonds have lost about 7%.

但一些科技公司在财务上比其他公司更脆弱。Oracle 正在争取成为像 OpenAI 这样的实验室的首选计算供应商,在这些公司中它无疑是负债最多的科技巨头。为了其大规模支出,它还需再举借数十亿美元,这促使穆迪评级和标普全球评级更接近将 Oracle 的债券重新归类为垃圾债券。近几周来,该公司股价下跌了 32%,其债券也下跌了约 7%。

There’s also the risk that the chips tech firms are borrowing to buy could be obsolete in a few years. Apart from its data-center investments, Blue Owl is lending money to an effort to buy Nvidia chips that will be leased by xAI.

还有一种风险是,科技公司为购买而举借资金购买的芯片几年后可能就会过时。除了其数据中心投资外,Blue Owl 还在为一项购买 Nvidia 芯片的行动提供贷款,这些芯片将由埃隆·马斯克的 xAI 租赁。

The last time Wall Street went all-in on an industry was the fracking boom—then bust—over a decade ago. This time, financiers are marshaling even larger sums.

上一次华尔街对一个行业大举押注并全力投入是十多年前的压裂繁荣——随后崩盘。这一次,金融家们筹集的资金甚至更为庞大。

The combined borrowing of every oil-and-gas company in the world from 2012 to 2015 was about 1.2 trillion from 2025 to 2028, according to the Morgan Stanley estimates.

根据 Dealogic 的数据,2012 年至 2015 年间全球所有油气公司的合计借款约为 1 兆美元。根据摩根士丹利的估算,从 2025 年到 2028 年,少数几家 AI 科技巨头将借款约 1.2 兆美元。

A new boomtown

As it happens, Blue Owl’s data-center project in Abilene is on the edge of the West Texas oil patch that was the epicenter of the fracking boom.

巧合的是,Blue Owl 在阿比林的数据中心项目位于德克萨斯西部油田的边缘,该地区曾是压裂繁荣的中心。

In late September, the firm invited executives from about 40 pensions, endowments and other institutions that invest in its funds to see the data center that will eventually rise from the Texas prairie. The investors donned hard hats and piled into five-person buggies to get a tour of the Abilene campus, which has a 5,000-car parking lot built just for its construction workers.

在九月下旬,该公司邀请了约 40 家投资其基金的养老基金、捐赠基金和其他机构的高管前来参观这座最终将从德州草原上升起的数据中心。投资者戴上安全帽,乘坐五人座的巡游车参观了阿比林园区,园区为施工工人专门建有一个可容纳 5,000 辆车的停车场。

The crews in Abilene are assembling eight different data-center buildings spanning around 4 million square feet. The campus will ultimately draw up to 1.2 gigawatts of power, or enough juice for about a million homes. Lining the insides will be around 500,000 Nvidia chips stuffed into dense racks requiring constant cooling.

阿比林的施工队正在组装八栋不同的数据中心建筑,总面积约为 400 万平方英尺。该园区最终将消耗多达 1.2 吉瓦的电力,或相当于大约一百万户家庭的用电量。内部将排列约 50 万块 Nvidia 芯片,装入密集的机架中,需要持续冷却。

Financially, the venture depends heavily on Oracle, which has leased it for 15 years. Oracle, in turn, will rely on a single customer, Sam Altman’s OpenAI, for some 100 billion to OpenAI—the sort of “circularity” that raises questions about whether AI revenue is being recycled.

在财务上,该风险投资高度依赖已租赁该项目 15 年的 Oracle。反过来,Oracle 将在约 3000 亿美元的长期收入中依赖单一客户 Sam Altman 的 OpenAI。与此同时,Oracle 正从 Nvidia 购买芯片,而 Nvidia 已向 OpenAI 投入 1000 亿美元——这种“循环性”让人质疑 AI 收入是否在被循环利用。

Spools of electrical wires in front of white assembly tents at the Stargate AI data center.

About $10 billion in loans were taken out to build the Abilene project. Kyle Grillot/Bloomberg News

大约有 100 亿美元的贷款被用于建设阿比林项目。KYLE GRILLOT/BLOOMBERG NEWS

The roughly $10 billion in loans taken out to build the Abilene project come due in five years and will be difficult to refinance if the Oracle-OpenAI partnership underperforms. Blue Owl offsets the higher risk of contracting with Oracle by charging higher rent than companies like Meta pay, a person familiar with the matter said.

用于建设阿比林项目的大约 100 亿美元贷款将在五年后到期,如果 Oracle-OpenAI 合作表现不佳,将很难再融资。一位知情人士表示,Blue Owl 通过收取高于 Meta 等公司支付的租金来抵消与 Oracle 签约的更高风险。

Many AI deals resemble the big buyouts private-equity firms have done for years, in which they raise a mound of debt to juice returns on their investment. In Meta’s Hyperion project, Blue Owl put in 27 billion borrowed from bond investors at a 6.58% interest rate.

许多 AI 交易类似于私募股权公司多年来进行的大型杠杆收购,即通过举借大量债务来提升投资回报。在 Meta 的 Hyperion 项目中,Blue Owl 从其私募股权基金投入了 30 亿美元,并从债券投资者处借入了 270 亿美元,利率为 6.58%。

The firm expects to make returns of about 13% annually off Meta lease payments, people familiar with the matter said. The new business could boost Blue Owl’s stock, which has declined 35% this year as concerns about private-credit defaults mounted.

知情人士表示,该公司预期能从 Meta 的租金支付中获得约 13%的年回报。随着市场对私募信贷违约的担忧加剧,Blue Owl 的股票今年已下跌 35%,而这项新业务可能提振其股价。

“There will be speculative AI investments. That’s not what we’re doing,” said Alexey Teplukhin, the Blue Owl managing director who ran the Hyperion investment.

“会有投机性的 AI 投资。那不是我们在做的事情,”负责 Hyperion 投资的 Blue Owl 常务董事 Alexey Teplukhin 说。

A crazy hypothetical

Banks are getting in on the action too. About a year and a half ago, bankers at JPMorgan got a call from a longtime client with what sounded like a crazy hypothetical: How would you finance a project to build a campus of AI data centers that would draw one gigawatt of power?

银行也加入了这场行动。大约一年半前,摩根大通的银行家接到一位长期客户的电话,内容听起来像个疯狂的假设:你们会如何为建设一个将消耗 1 吉瓦电力的 AI 数据中心园区提供融资?

WSJ’s Take On the Week

How Trillions in New AI Debt Will Test the Bond Market

数万亿美元的新人工智能债务将如何考验债券市场

In this week’s episode of WSJ’s Take On the Week, co-hosts Gunjan Banerji and Telis Demos discuss the lingering economic impact of the U.S. government shutdown and why a lack of crucial inflation and jobs data is making the outlook murky for the Federal Reserve. Next, Nvidia is set to report its third-quarter earnings this week. And Morgan Stanley estimates that only half of the roughly 18 Billion Bond Sale Meets Strong Investor Demand For more coverage of the markets and your investments, head to WSJ.com, WSJ’s Heard on The Street Column, and WSJ’s Live Markets blog. Sign up for the WSJ’s free Markets A.M. newsletter. Follow Gunjan Banerji here and Telis Demos here.Read Transcript

The bankers told their client, a developer and landlord called Vantage Data Centers, that it would never need that much capacity. But they walked through how they would theoretically raise the money.

银行家告诉他们的客户——一家名为 Vantage Data Centers 的开发商和房东——它永远不需要那么大的容量。但他们还是演示了理论上如何筹资。

Earlier this year, Vantage called JPMorgan to say it wanted to pull the trigger, with one tweak. Instead of building a single 1-gigawatt data center, it wanted to build two of them. Not long after, JPMorgan and a group of other banks agreed to lend $38 billion for a data center in Texas’ Shackelford County and another one outside Milwaukee, Wis.

今年早些时候,Vantage 致电摩根大通表示想要动手实施,但做了一个调整。它不想建一个 1 吉瓦的数据中心,而是想建两个。不久之后,摩根大通和其他几家银行同意为位于得克萨斯州 Shackelford 县的一座数据中心和威斯康星州密尔沃基郊外的另一座数据中心提供 380 亿美元贷款。

The five-year debt package, named Jacquard, was so jumbo-size that more than 30 other banks, from global giants such as JPMorgan to regional players such as U.S. Bancorp, were tapped to sell portions to investors. They are pitching insurers, corporate debt funds and almost every type of bond buyer.

这份名为 Jacquard 的五年期债务打包规模之大,以至于超过 30 家其他银行——从摩根大通等全球巨头到美国合众银行等区域性机构——都被动员来向投资者出售部分份额。它们向保险公司、企业债基金以及几乎所有类型的债券买家推介该产品。

Morgan Stanley has decadeslong ties to top-tech companies, and the firm’s bankers began pitching them financing options for big data centers two years ago. The effort delivered in October, when the bank arranged deals worth about 20 billion sale of Aligned Data Centers and a $3.2 billion junk bond.

摩根士丹利与顶尖科技公司有着数十年的联系,该行的银行家们在两年前开始向这些公司推介用于大型数据中心的融资方案。这一努力在十月得以兑现,当周该行促成了约 750 亿美元的交易,包括为 Meta 的 Hyperion 提供的债务、价值 200 亿美元的 Aligned Data Centers 出售以及一笔 32 亿美元的垃圾债券。

“I’ve been doing this for 25 years and I’ve never seen a week like that,” said Anish Shah, Morgan Stanley’s global head of debt capital markets.

“我已经做了 25 年,从来没有见过那样的一周,”摩根士丹利全球债务资本市场负责人 Anish Shah 说。

$2 billion in three days

AI infrastructure dealmaking can be extremely lucrative for money managers, if everything goes according to plan.

如果一切按计划进行,AI 基础设施交易对资金管理者来说可以非常赚钱。

In the case of Jacquard, the debt pays interest of about 6.4%, almost 2 percentage points higher than the yield on a comparable corporate bond from Oracle. Other deals have delivered far bigger gains.

就 Jacquard 而言,该债务的利息约为 6.4%,几乎比 Oracle 可比公司债券的收益率高出 2 个百分点。其他交易带来的收益远高得多。

When Blue Owl went looking to borrow the money it needed for the Meta project, the firm and Morgan Stanley settled on Pimco, an asset manager known for its expertise in fixed income. Pimco committed to buying $18 billion of the bonds, ensuring the deal’s success, but demanded a high interest rate and guarantees in exchange.

当 Blue Owl 寻求为 Meta 项目筹借所需资金时,该公司与摩根士丹利最终选定了以固定收益见长的资产管理公司 Pimco。Pimco 承诺购买 180 亿美元的债券,确保了交易的成功,但作为交换要求较高的利率和担保。

Talk of the deal circulated over the summer, and other funds asked to participate but were shut out. That created pent-up demand, and when the bonds began trading in October, prices jumped by about 10% in a matter of days, giving Pimco 1.1 billion.

有关该交易的传闻在夏季流传开来,其他基金曾要求参与但被排除在外。这造成了积压的需求,当这些债券在十月开始交易时,价格在几天内上涨了约 10%,使 Pimco 获得了 20 亿美元的账面利润。此后价格略有回落,将收益缩减到仅 11 亿美元。

Bond funds are clamoring for the deal because it delivers high returns, or yields, typical of junk bonds but with protections associated with investment-grade credit ratings. Ratings firms scored the bonds so highly because Meta pledged that bondholders and Blue Owl will get all their money back, even if it stops leasing the data center.

债券基金争相购买这笔交易,因为它提供了类似垃圾债券的高回报率或收益,同时具备与投资级信用评级相关的保护。评级机构之所以给予这些债券如此高的评分,是因为 Meta 承诺即便停止出租该数据中心,债券持有人和 Blue Owl 仍将收回全部资金。

“Even if the loot ends up not being as glorious as everyone thinks it may be with AI, we still think these are the best companies in the world,” said Blue Owl’s Teplukhin.

“即便最终收益并不像大家想象的那样因 AI 而辉煌,我们仍然认为这些是世界上最好的公司,”Blue Owl 的 Teplukhin 说。

Write to Matt Wirz at [email protected] and Peter Rudegeair at [email protected]

请向 Matt Wirz([email protected])和 Peter Rudegeair([email protected])发送来稿。